-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Pump and Dump

Pump and Dump

What is Pump and Dump?

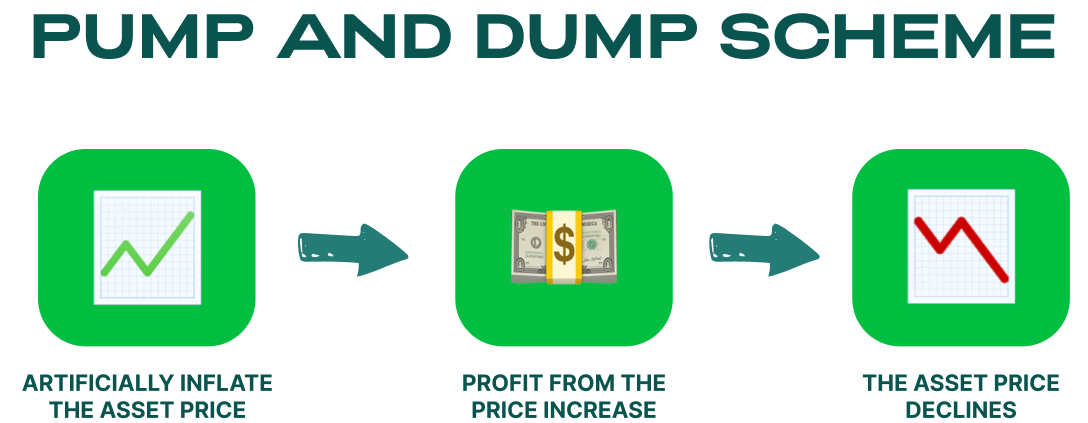

Pumps and dumps are ordinary events for the stock and crypto market. This scheme is a type of fraud that involves the price's artificial inflation (“pump”) through false, misleading, or exaggerated statements regarding the related project. The fraudster can profit from buying the asset before the price inflation (“pump”) and selling the securities at a high price (“dump”).

At the same time, the other owners of the shares will likely lose a substantial part of their capital because of unexpected movements. The pump and dump scheme is considered an illegal activity.

How Does the Pump and Dump Scheme Work?

The scheme often involves the manipulation of microcap stocks or crypto projects with small market capitalization. Market players with significant capital (whales) can manipulate the price of these projects and create artificial movements since microcap stocks are highly illiquid securities with low trading volume.

Moreover, the fraudsters can easily manipulate the information about the small companies and crypto projects. The lack of public information creates additional favorable conditions for fraudsters as potential investors don’t have enough sources to check all available information about a company.

Fraudsters may use various tools in a pump and dump scheme, including cold calling, email spam, and fake news releases.

Types of Pump and Dump Schemes

There are several types of pump and dump schemes that fraudsters may utilize. They include the following:

Classic pump and dump scheme

The classic scheme may involve any manipulation of information regarding a company and its stock. It may include stock pitches via telephone, fake news releases, and distribution of some “inside” information that can boost the stock price.

Boiler room

A boiler room is a small brokerage firm that employs several brokers that use dishonest sales practices to sell questionable investments to investors. The brokers sell penny stocks that the firm buys or sells as a market maker by employing cold calling. The brokers at boiler rooms are trying to sell as many stocks as possible, boosting the price. Once the price rises, the firm sells its shares for a profit.

Pump-and-Dump 2.0

The same scheme can be created by anyone who can affect many retail investors. For example, a host of any telegram channel with a large auditory can convince other investors to buy a stock that is supposedly "ready to take off." The schemer can get the action going by buying heavily into a stock that trades on low volume, which usually pumps up the price.

The price action induces other investors to buy heavily, increasing the share price. When the perpetrator feels the buying pressure is ready to fall off, they can sell their shares for a significant profit.

Everyone will remember 2021 for significant pumps and dumps made by a group of Reddit retail traders. They were looking for stocks with the biggest "short volume value" and calling for a purchase. Thousands of traders were buying the same stock causing a massive pump. Moreover, at some point, funds and traders who had a "short" position in this stock had to close it, causing the price to fly even higher. As soon as the price lost momentum, investors began to sell the stock, causing a dump.

As a result, shares of AMC have surged a staggering 570% over the month, as heightened options activity and increasing short interest in the stock help retail traders squeeze institutional investors betting on a decline out of their risky bets.

Pump-and-Dump 3.0

The cryptocurrency market has become the newest arena for pump-and-dump schemes. The massive gains made by Bitcoin and Ethereum have kindled tremendous interest in cryptocurrencies of every stripe. Unfortunately, cryptocurrencies are particularly well-suited for pump-and-dump schemes due to the lack of regulation and the technical complexity of cryptocurrencies.

A study conducted in 2018 examined the prevalence of pump-and-dump schemes in the cryptocurrency market. Researchers identified more than 3 400 schemes over just six months, observing two group-messaging platforms popular with cryptocurrency investors.

The situation is similar to the stock market. Investors collaborate into groups and pump coins with small capitalization, causing a short squeeze, which pushes the price even higher. At some point, manipulators sell the coin and dump it back to historical lows.

Avoiding Pump-and-Dump Schemes

The Securities and Exchange Commission (SEC) has some tips to help avoid becoming a victim of a pump-and-dump scheme. Here are some points to keep in mind:

Look Out for Obvious Red Flags

Does the purported investment sound too good to be true? Does it promise huge "guaranteed" returns? Are you pressured to buy right now, before the stock takes off? These are all common tactics used by promoters and should be viewed as red flags by investors.

Conduct Your Own Research and Due Diligence

Before investing your hard-earned money, conduct your research and due diligence. It is easy to obtain a wealth of information online about legitimate companies—from their business prospects and management to their financial statements. The lack of such information can often be a red flag.

2022-11-22 • Updated