What Are Order Blocks In Forex?

Retail traders aren't the only players in the Forex market. In addition to them, there are other, much larger participants like central banks and financial institutions. Since they have much more funds than an average trader, they usually make large transactions divided into order blocks.

In this article, you will learn what Forex order blocks are, how to find them on a price chart, and how you can use them to your advantage.

What is a Forex order block?

Unlike retail traders whose primary motivation is profit, big market players place orders for various reasons. Central banks, for instance, do it to control the price of their national currencies; companies and financial institutions, meanwhile, may do it as part of their hedging strategy. In any case, when they enter the market, they bring a lot of money into it.

However, can you imagine what would happen to the price of Forex pairs if these financial institutions placed the entirety of their order in one trade? The market would get extremely destabilized, and the price would either skyrocket or drop, making it less profitable for institutions. That's why they divide their order into several much smaller trades, creating a backlog of orders which will get fulfilled without putting a strain on the market.

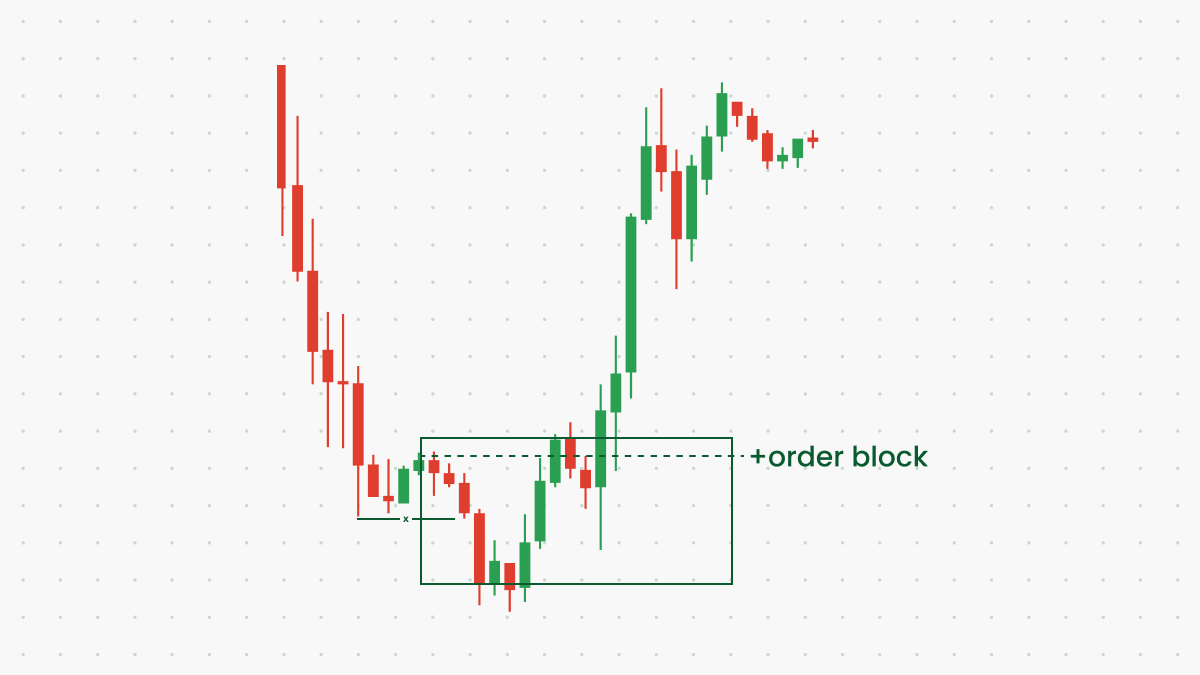

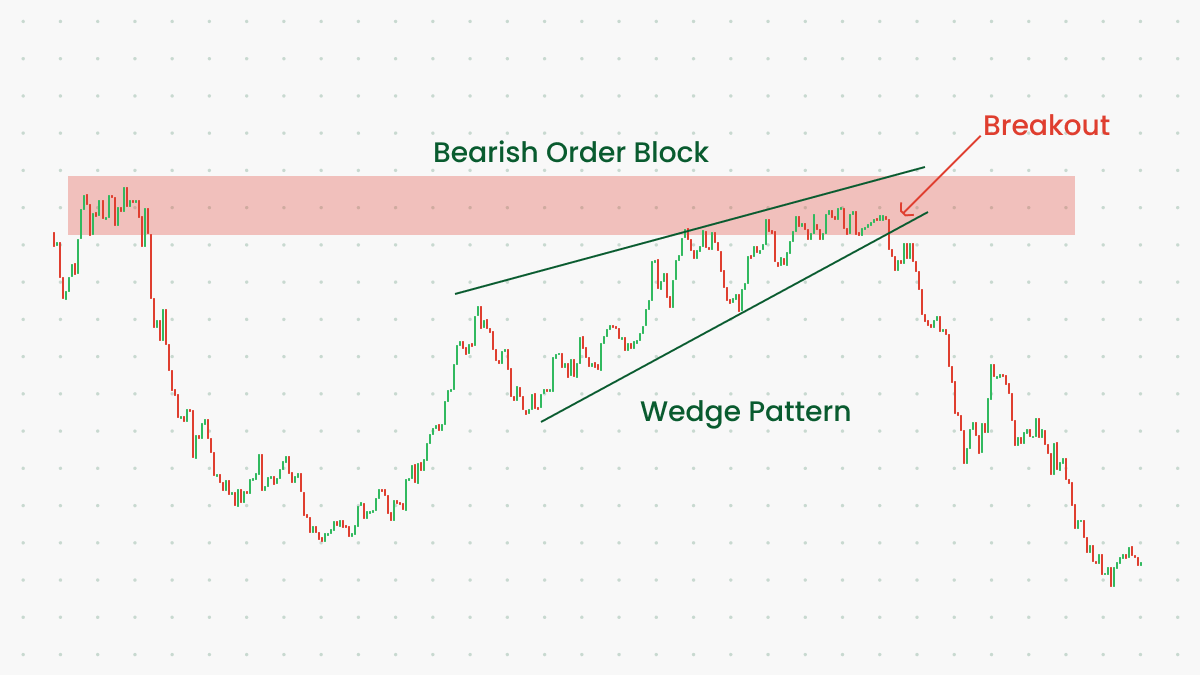

So, in Forex trading, order blocks are areas on a price chart where large financial institutions try to purchase or sell currency pairs without impacting the market. And if you look at a price chart, an order block appears as a cluster of orders concentrated at a particular price level. These levels can act as support and resistance, reversal and breakout points, and generally precede sharp market moves.

The importance of order blocks

You may be wondering why you need to learn about order blocks even though you aren't affiliated with larger financial institutions. But while order blocks are placed specifically to prevent a significant impact on the price of a currency pair, they still affect the market.

- Large financial institutions often have a lot more sources of information available to them. Because of this, they may try to take advantage of the industry news before the rest of the market participants. Retail traders are aware of this, so they often follow big market players, which might change the market sentiment entirely.

- Since order blocks consist of multiple orders executed around the same level, they can increase or decrease the price. This impact isn't as dramatic as it could have been if institutions placed one big trade, but it's enough to make a difference.

- Sometimes, order blocks may cause price volatility. This can happen due to changes in market liquidity. Since order blocks are huge, completing them might affect the supply and demand levels. This imbalance is what causes price volatility, and it may take some time for the market to get back to normal.

As you can see, order blocks affect the market even if it may not be obvious initially. That's why knowing how to recognize order blocks on a chart can help you prepare for potential market changes.

How to identify an order block

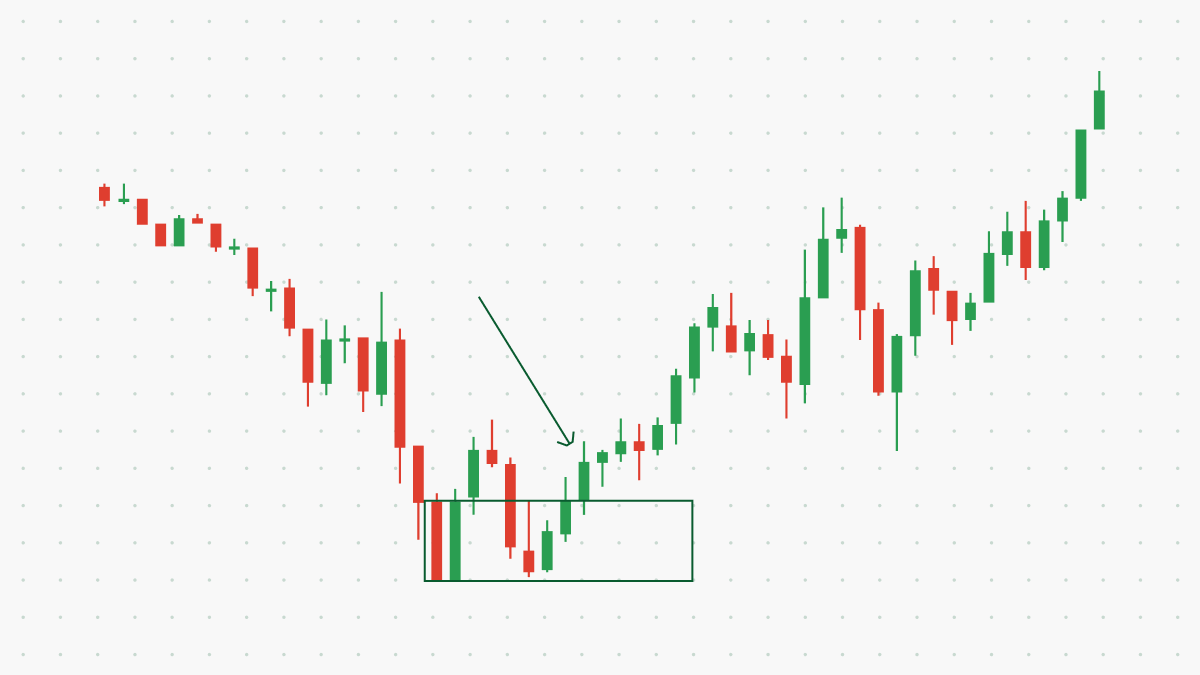

Generally, order blocks follow after a strong uptrend or downtrend. On a price chart, they look like a cluster of candlesticks, indicating a high level of trading activity happening at a certain price level. However, not every cluster of candlesticks is an order block. To check if a formation you see is an order block, you have to utilize other tools and look for other signals.

For example, volume indicators like the on-balance volume indicator, volume price-trend indicator, and the Klinger Oscillator can help you determine if a large volume of trades is happening at a particular price level. If the volume is large, there's a great chance that some financial institution has placed an order block.

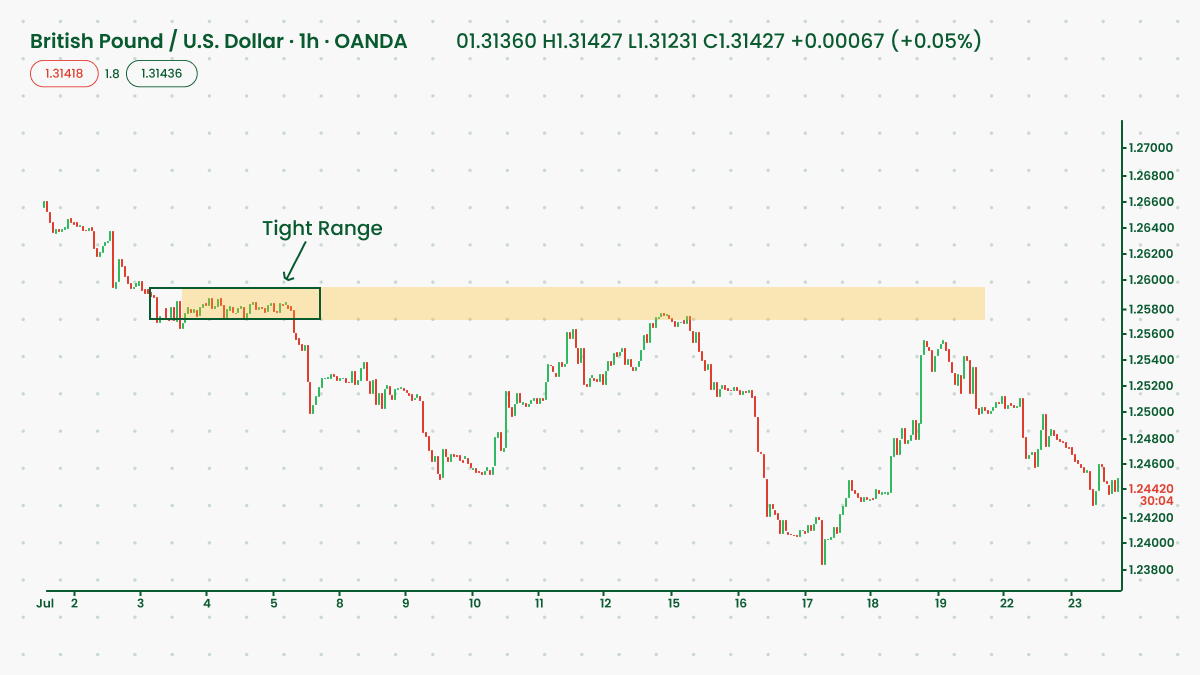

Another sign of a potential order block is a ranging market. Ranging markets occur when the price doesn't follow a particular trend. Instead, it fluctuates in a very narrow range, bouncing from support and resistance levels. Strong support and resistance levels may also accompany order blocks.

Since order blocks are pretty rare, it's essential to look for a combination of these signs to get a strong confirmation that a formation you see on a chart is an order block.

Order blocks: trading strategies

If you identify order blocks successfully, you can use them to your advantage. There are different ways to incorporate order blocks into your trading strategy:

- Finding support and resistance levels. Since the price in an order block fluctuates within a tight range, the levels from which it bounces act as support and resistance. You can open a position when the price breaks through one of the levels and place a stop-loss order below (for buy trades) or above (for sell trades) the broken level. Be careful, though, because the first breakout might be a test, and the price might pull back into the order block.

- Trading breakouts. Order blocks usually precede strong bullish or bearish trends. You can wait until the price breaks out of an order block and enter a trade once the direction of a new trend is identifiable.

- Looking for reversal signals. Occasionally, order blocks may be accompanied by reversal chart or candlestick patterns. If you notice a reversal pattern on a chart, wait until the price breaks out of an order block. Then, you can enter a trade in the direction opposite from the previous trend.

As you can see, order blocks can be utilized in several different ways, provided you have identified an order block correctly.

Order blocks: summary

Order blocks occur when big market players enter the Forex market. While it's impossible to trade against large financial institutions, order blocks present an excellent opportunity for retail traders to use the actions of prominent market players to their advantage. At the same time, order blocks are rare, so it may be hard to identify them on a price chart.