Forex Trading Scams: Forewarned Is Forearmed

Ever felt the rush of potential gains in Forex trading? It's certainly an exciting space, but there's a darker side that often lurks behind promises of quick profits. Picture this: you're diving into the Forex market, eager to make your money work for you and find yourself trapped in a web of deceit.

Scammers are masters of disguise, weaving intricate schemes that seem too good to be true. They dangle the allure of massive profits or exclusive 'foolproof' strategies, preying on unsuspecting traders and investors alike. And before you know it, your hard-earned money could vanish into thin air.

This article sheds light on the treacherous world of Forex scams, uncovering the most common fraudulent tactics and equipping you with knowledge on how to avoid them.

Key takeaways

- Trade with a regulated Forex broker and be critical of claims of guaranteed profits.

- Avoid sharing personal data with unverified sources.

- Utilize demo accounts to test trading platforms.

- If you are the victim of fraud in the Forex market, collect evidence, contact a broker and your bank or payment provider to report the scam transaction, and consult a legal professional with experience in Forex trading scams.

The most common Forex scams

In the world of Forex, it is essential to recognize unfair trading practices whether you are a seasoned trader or a newbie. This section highlights the most common Forex scam tactics to help traders identify and protect themselves against unfair activities in the market.

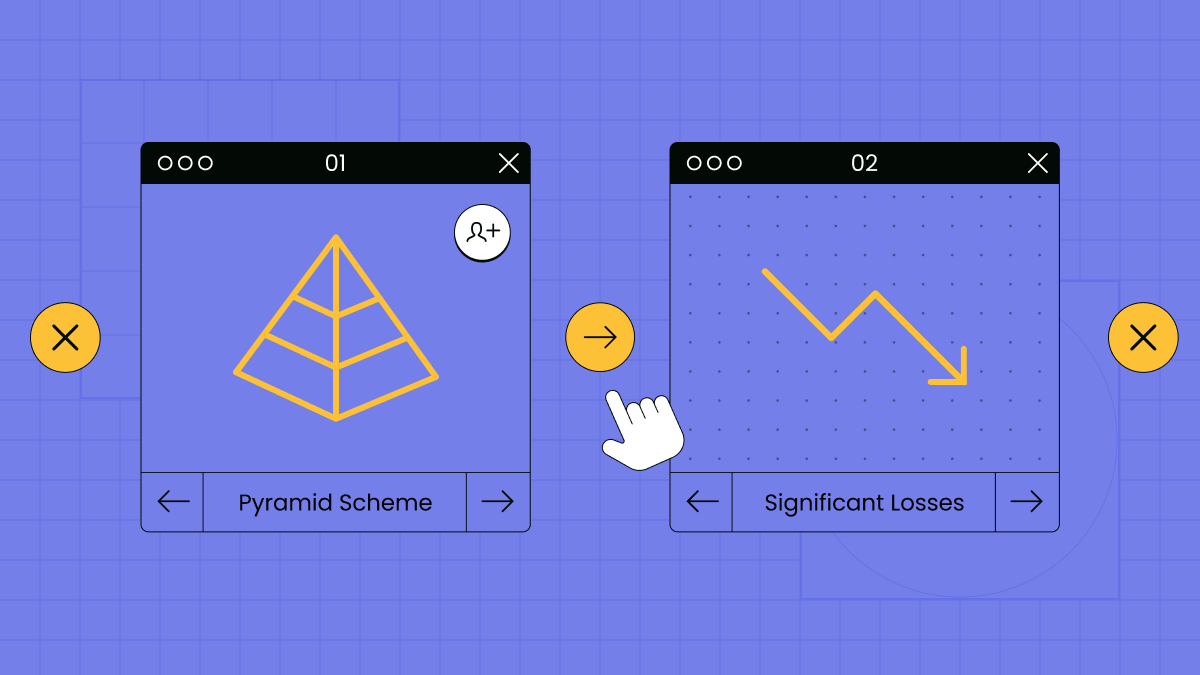

Pyramid schemes

Pyramid schemes are a form of financial fraud that has infiltrated the Forex industry. They entrap individuals with promises of massive profits. Pyramid schemes exist under the cover of legitimate investment opportunities. The founders operate as funds where capital is gathered to make investments on behalf of clients. This type of fraudulent activity is based on recruiting new participants who have to make an initial investment, with the promise of substantial returns through recruiting others into the scam scheme. The focus of pyramid schemes is precisely recruiting more members, and not trading practice. Such pyramids grow until they suddenly collapse, causing significant losses for defrauded investors.

Here are the red flags common for pyramid schemes in Forex:

- guarantee of significant returns;

- lack of actual trading activities;

- pressure to bring in new members in order to get a payment.

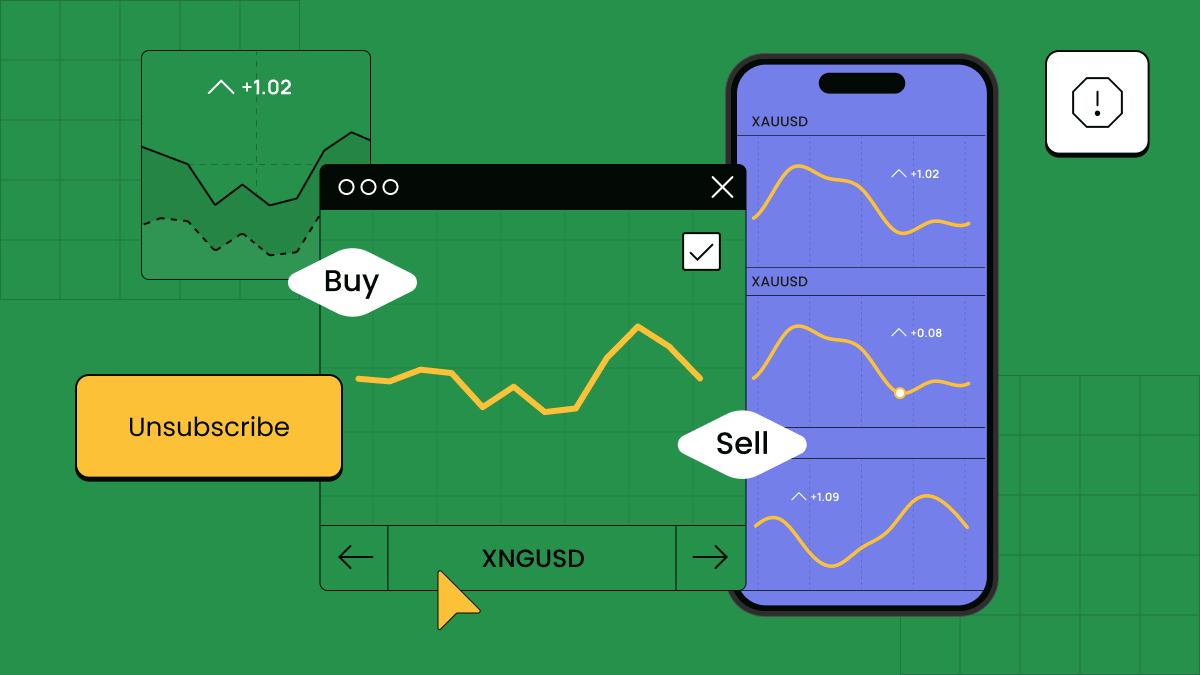

Signal service scam

Signal service scams in Forex are widespread schemes where individuals or companies guarantee they will provide reliable and accurate trading signals to traders for a fee. However, these fraudulent providers fabricate the signals, which results in substantial losses for unsuspecting victims.

In signal service scams, wrongdoers capitalize on traders’ desire to make easy profits by relying on the expertise of others. They often use attractive marketing tactics and create a false perception of success to find subscribers. Once traders sign up and pay the subscription fees, they receive randomly generated signals deliberately designed to manipulate them into entering losing trades.

The typical actions intrinsic to Forex signals scammers:

- persuading you that Forex trading is easy and you can achieve overnight wealth without any effort or skills;

- requiring upfront payments without providing any verifiable proof of their signal performance;

- engaging in aggressive marketing tactics such as cold calling or spam emails to target inexperienced traders;

- offering bonuses to lure new customers and expand their network;

- failing to provide consistent signal updates, resulting in delayed or outdated information.

So, if someone offers you the opportunity to get rich quickly, they will most likely get rich at your expense, leaving you with nothing.

Managed Forex account scams

Managed trading account scams in Forex involve offering fraudulent services to manage traders’ funds on their behalf. Typically, scammers present themselves as professionals providing false information about successful trading records. They attract traders by making promises of high returns and minimal risk.

To participate in the scheme, scammers ask traders to deposit a significant amount of money into a managed account, persuading them to use it for Forex trading under the expertise of their team. By providing traders with false reports and statements, the fraudsters create an illusion of active trading. They can even give traders online access to a trading platform that demonstrates false trades and fictitious profits.

Alongside the initial investment, scammers also collect management fees that they regularly deduct from the trader's account. These fees help providers create the appearance of legitimate activity.

Over time, the scammers typically initiate a series of losing trades or stop trading altogether. This inevitably causes significant losses for victims. Once the scheme collapses, the scammers vanish, cutting off all communication and leaving their clients with little to no chance of recovering their capital.

Under no circumstance should you tell anyone your password for your Forex account because you will lose control over your money, and the fraudster will most likely disappear without a trace.

Red flags for managed account scams:

- urgency to deposit your Forex trading account;

- lack of transparency while answering traders’ questions;

- hard-pressure selling of their services;

- unrealistic claims about trading performance;

- obstacles and delays when traders want to withdraw their funds.

Unregulated Forex brokers

In the Forex market, unregulated brokers pose a significant risk to traders. These brokers operate without regulatory compliance, exposing traders to potential fraudulent activities. Unregulated brokers lack essential licensing, authority supervision, and corresponding accountability. These market participants cannot ensure fairness, customer protection, and transparency. That’s why fraudulent brokers tend to operate in the shadow, hiding their actual location.

The lack of oversight allows fraudulent brokers to engage in manipulative practices. Scammers may use client deposits for personal expenses or other unauthorized purposes. Unregulated brokers may manipulate margin requirements and leverage offered to traders, which causes excessive risk exposure or automatic liquidation of trader positions. These brokers may also manipulate prices or spreads in the trading platform, leading to unfavorable execution of trades.

Unlike regulated brokers, unregulated ones typically do not offer any protection or compensation to traders facing financial insolvency or fraudulent activities.

Red flags to watch out for:

- limited or nonexistent complaint resolution mechanisms;

- absence of clear legal documentation;

- warnings and negative feedback on the internet;

- lack of trader protection;

- hidden location of brokers’ headquarters.

FBS has a global license and is a reliable broker. It has been on the market for 14 years, eliminating the risk of scams.

Social media Forex scammers

Social media has become a perfect platform for Forex scammers. Social networks enable wrongdoers to spread information and catch the attention of the masses easily. These scammers, in turn, utilize various tactics to deceive individuals and commit fraudulent activities.

For example, using social media, scammers can create fake profiles and pose as successful traders or brokers, trapping people into investing in their schemes or purchasing their fake services. Scammers may post false statements and stories of unattainable success, demonstrating luxury lifestyles and promising their followers high returns.

Furthermore, such scammers can hold fake trading contests, promising participants a chance to win substantial money. They use these tactics to gather personal information from unsuspecting individuals or convince them to deposit funds into fake trading accounts.

Another common method used by Forex scammers on social media is spreading false information and market analysis. These fraudsters take money from traders promising good analytics but post misleading charts and news instead.

Here are the warning signs of social media Forex scams:

- unexpected messages and friend requests;

- fake profiles with stolen pictures;

- aggressive sales tactics;

- poor grammar and spelling mistakes;

- direct requests for personal information and deposits;

- guaranteed profits.

Fake trading robots

Trading robots, also known as expert advisors (EAs), are specific computer programs that use algorithms and preset rules to execute trades in financial markets such as Forex automatically. These mechanisms analyze the market conditions and open or close positions without manual effort.

While legally established trading robots can be beneficial, the issue of fraudulent programs has been escalating. Fake Forex trading robots are shell programs that provide no actual trading advantages, as they do not utilize efficient algorithms or strategies. Traders who become victims of these scams not only lose the money they spend on purchasing the robot but also may experience significant losses if they rely on the robot's trading signals.

Here are some warning signs for fake Forex trading robots:

- promotion of fake brokers;

- showcasing that Forex is simple, and it is not necessary to have specific knowledge when the program can work on behalf of you;

- assurance of significant returns;

- lack of information about the robot's functioning;

- poor design and language.

The best way to avoid scams is to use official and trusted sources, like the MQL5 robot store, and read reviews from real people on trusted sites.

Steps to avoid Forex trading scams

To reduce the risk of falling into the trap of Forex scammers and protect your capital, traders should follow a time-tested set of rules. These rules include the following:

-

Select a regulated and reliable Forex broker

When searching for Forex brokers, choosing those that comply with regulations set by reputable financial authorities is crucial. Consider FBS as an example. As a fully regulated broker, we prioritize adherence to strict standards of transparency and accountability. Compliance with legal provisions and industry standards ensures we act within specific guidelines, protecting the interests of our traders.

To assess our reliability and credibility, examining the reputation of your potential broker within the trading community is essential. With over 27 million FBS clients, we encourage you to check the reviews and feedback from our satisfied customers.

Plus, it is essential to evaluate the quality of customer support your chosen broker provides. At FBS, our dedicated customer support team is available 24/7 in multiple languages. Whether you have questions or concerns, we are here to assist you promptly and effectively.

-

Avoid promises of guaranteed profits

Traders must exercise critical thinking when promised a fortune in Forex trading. It is important not to rely on statements that guarantee extraordinary investment returns. Traders should keep in mind that Forex trading is a challenging process with inherent risks, and no one can predict market movements with 100% accuracy. Maintaining a realistic outlook and understanding the risks will help traders make informed decisions and avoid falling for unfounded promises.

-

Educate yourself

As in any other field, success in Forex trading necessitates a continuous commitment to education. The more knowledge and understanding of market dynamics you possess, the better equipped you will be to identify fraudulent activities and make sound trading decisions.

Many reputable brokers provide their users with high-quality educational materials that help traders enhance their skills. For example, the broker FBS offers its clients a comprehensive academic basis with the Forex guidebook, tips for traders, webinars, seminars, video lessons, etc. A team of the best experts and market analysts creates and enhances these valuable resources daily.

Make the most of these educational opportunities to maximize your trading potential and stay informed in the constantly changing Forex market.

-

Start low, go slow

Deposit a small amount of money when dealing with Forex brokers in order to test their reliability. This gives you a chance to assess the broker's performance and take necessary precautions before making substantial investments. It is recommended to continue depositing funds only if you are satisfied with the broker's services. This approach allows you to minimize risk exposure and make informed decisions when dealing with legitimate Forex brokers.

-

Protect personal and financial information

It is essential to exercise caution and think twice before sharing any personal information, such as passwords, credit card data, financial documentation, or other sensitive details, with unverified platforms or sources.

-

Trust yourself

If you feel the offerings are too good to be true, trust your instincts and forget about working with that individual or platform. Trusting your gut feeling can be a powerful tool in protecting yourself from falling victim to Forex scams. Always prioritize your own judgment and trust yourself when it comes to making decisions in the Forex market.

Following these rules can help safeguard against potential scams and protect your privacy and financial well-being.

Summary

As the largest and most liquid financial market, Forex has unfortunately attracted not only individuals seeking wealth through currency trading but also dishonest individuals aiming to exploit others. To avoid falling victim to Forex scams, traders should seek a regulated and reputable broker who complies with established regulations.

Consider FBS as your reliable and honest trading broker to see that trading Forex can be safer.

FAQ

How do I avoid scams in Forex trading?

To avoid scams in Forex trading, follow these steps:

- Choose a regulated Forex broker.

- Be critical of claims of guaranteed profits.

- Avoid sharing personal data with unverified sources.

- Expand your trading horizons.

- Trust your judgment.

- Utilize demo accounts to test trading platforms.

How do I know if a Forex trader is legit? To determine if a selected Forex broker is legit, traders should conduct thorough research.

- Check if a broker complies with the regulations and industry standards.

- Learn how transparent the broker is. Legitimate brokers are always transparent about their performance history, trading conditions, and provided services.

- Analyze the mechanism of sensitive data protection.

- Check the reliability and professionalism of their customer support.

- Research the broker’s reputation in the Forex community.

What should I do if I was scammed in the currency market?

If you are the victim of fraud in the Forex market one day, it’s crucial to act immediately. Here are some steps you need to take:

- Collect evidence, including screenshots, emails, and all the relevant documentation.

- If the scam occurred through a broker, contact them immediately and explain the situation.

- Consult a legal professional with experience in Forex trading scams.

- Contact your bank or payment provider to report the scam transaction.

- Share your experience with other traders through social media or other sources.

What is the safest Forex strategy?

There is no single strategy that will safeguard all your funds. Each trader has a unique trading style and risk tolerance. Hence, developing a strategy that aligns with your individual goals and preferences is the best option to reach long-term success.